It can be used by homeowners and businesses to calculate the return on energy-efficient technologies such as solar panels and insulation, including maintenance and upgrades. If opening the new stores amounts to an initial investment of $400,000 and the expected cash flows from the stores would be $200,000 each year, then the period would be 2 years. In addition, the potential returns and estimated payback time of alternative projects the company could pursue instead can also be an influential determinant in the decision (i.e. opportunity costs).

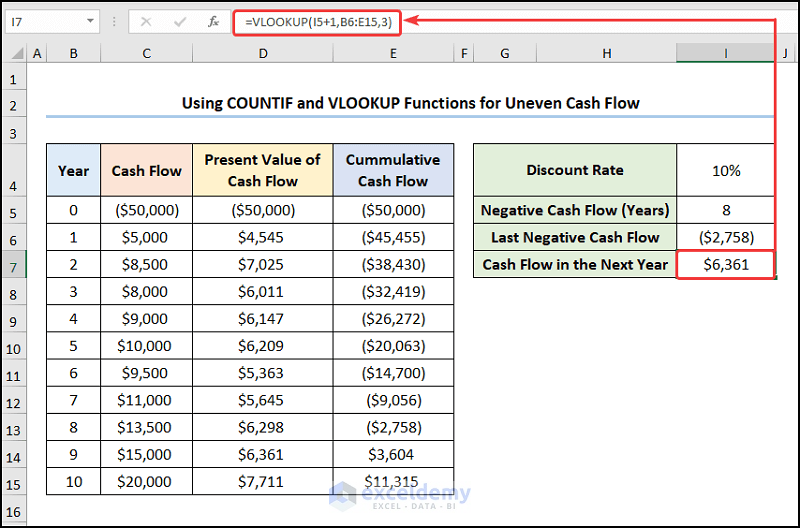

Payback method with uneven cash flow:

The trouble with piling all of the calculations into a formula is that you can’t easily see what numbers go where or what numbers are user inputs or hard-coded. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. First, we’ll calculate the metric under the non-discounted approach using the two assumptions below. But since the payback period metric rarely comes out to be a precise, whole number, the more practical formula is as follows.

Formula

The project is expected to generate $25 million per year in net cash flows for 7 years. Keep in mind that when working with uneven cash flows, the payback period calculation may not provide you with a precise number of years or months. In such cases, consider using an Excel spreadsheet or other software to help calculate and visualize the payback period more accurately. Previously we mentioned that companies look for the shortest payback periods. This is so the money is not tied up for too long and management can reinvest it elsewhere, perhaps in additional equipment that will generate more profit. But what if the machine for Jimmy’s Jackets will no longer be profitable past 3 years?

Payback Period: Definition, Formula, and Calculation

- Average cash flows represent the money going into and out of the investment.

- Or the numbers suddenly start fluctuating downwards from year 3 on?

- The definition of a good or preferable payback period varies, but the general assumption is that the shorter the period the better, because of the liquidity it provides.

- The payback period is favored when a company is under liquidity constraints because it can show how long it should take to recover the money laid out for the project.

First, we need to create the dataset including cash flows and cumulative cash flows. As our initial investment is a cash outflow, we denote it as a negative value. Using these values, we can create the cumulative cash flows column. To calculate the cumulative cash flow balance, add the present value of cash flows to the previous year’s balance. The cash flow balance in year zero is negative as it marks the initial outlay of capital.

Payback period formula for even cash flow:

You can also increase the cash flow by a fixed percentage over the years if like so. The payback period is the amount of time (usually measured in years) it takes to recover an initial investment outlay, as measured in after-tax cash flows. stockholders equity balance sheet guide, examples, calculation It is an important calculation used in capital budgeting to help evaluate capital investments. For example, if a payback period is stated as 2.5 years, it means it will take 2½ years to receive your entire initial investment back.

Posts from: Excel Cash Flow Formula

The answer is found by dividing $200,000 by $100,000, which is two years. The second project will take less time to pay back, and the company’s earnings potential is greater. Based solely on the payback period method, the second project is a better investment if the company wants to prioritize recapturing its capital investment as quickly as possible. Unlike other methods of capital budgeting, the payback period ignores the time value of money (TVM). This is the idea that money is worth more today than the same amount in the future because of the earning potential of the present money. When deciding whether to invest in a project or when comparing projects having different returns, a decision based on payback period is relatively complex.

The decision rule is to accept the project only if its payback period is less than the target payback period. In most cases, this is a pretty good payback period as experts say it can take as much as 7 to 10 years for residential homeowners in the United States to break even on their investment. Since technology is not going anywhere and does more good than harm, adapting is the best course of action. We plan to cover the PreK-12 and Higher Education EdTech sectors and provide our readers with the latest news and opinion on the subject. From time to time, I will invite other voices to weigh in on important issues in EdTech. We hope to provide a well-rounded, multi-faceted look at the past, present, the future of EdTech in the US and internationally.

Depreciation is a non-cash expense and therefore has been ignored while calculating the payback period of the project. Here’s a hypothetical example to show how the payback period works. Assume Company A invests $1 million in a project that is expected to save the company $250,000 each year. If we divide $1 million by $250,000, we arrive at a payback period of four years for this investment. Others like to use it as an additional point of reference in a capital budgeting decision framework.

If the investment is prone to obsolescence, a shorter payback time can help investors assess whether an investment can be recouped and a profit made before it becomes obsolete. From the dropdown box, select how many yearly cash flows input boxes you want for your project. What it meaans is that investment in to the project is always a Cash outflow (negative number) from you. The time value of money is an important consideration for a business. The payback period method is particularly helpful to a company that is small and doesn’t have a large amount of investments in play.